Colorado Uniform Consumer Credit Code

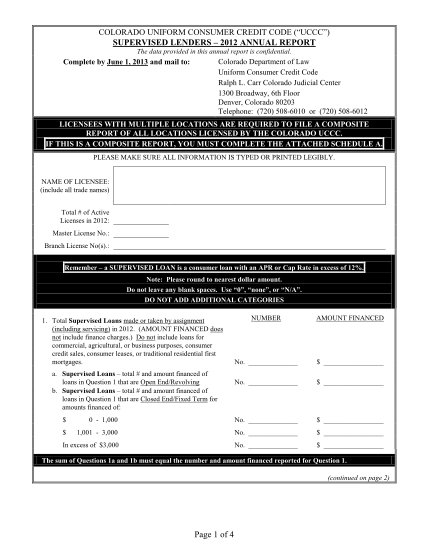

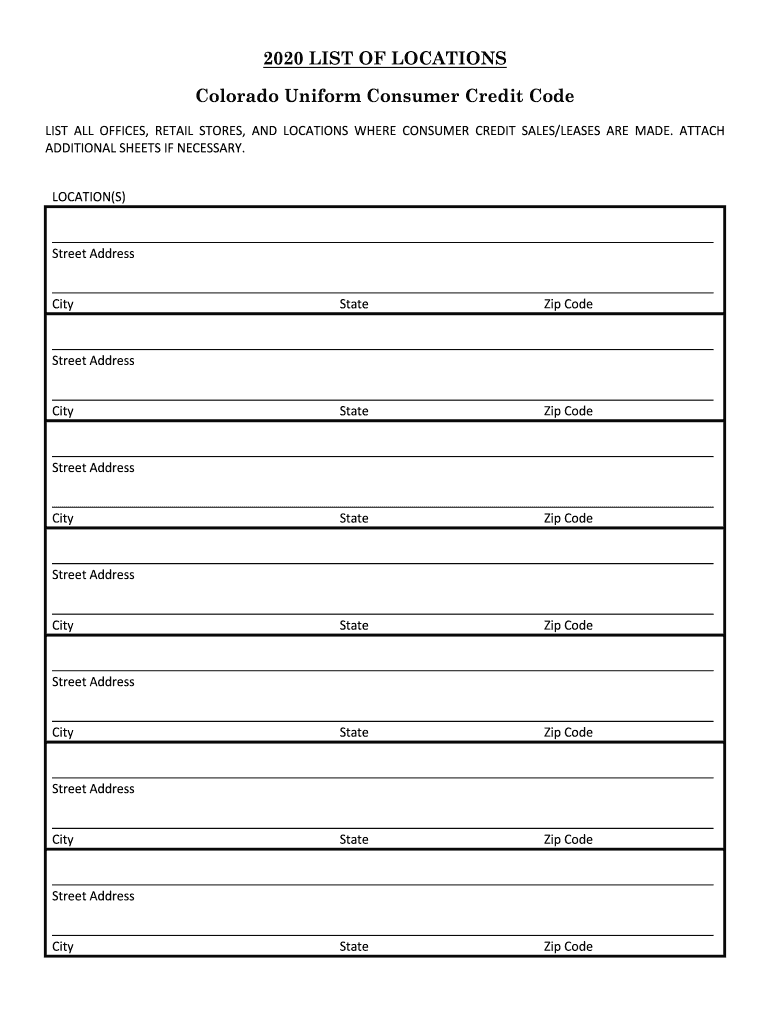

Fillable Online Coloradoattorneygeneral Colorado Uniform Consumer The colorado uniform consumer credit code (uccc) is a state law that regulates the terms and conditions of consumer credit in the state of colorado. it sets maximum rates and charges, requires disclosure of the cost of credit so consumers may shop for the best rates, and provides remedies for consumers on default. The colorado uniform consumer credit code (“uccc”) is a state law that regulates the terms and conditions of consumer credit in the state of colorado. this includes nonbank lenders, such as supervised lenders, retail sellers, finance companies, installment lenders, second mortgage companies, and rent to own companies.

19 Medical Examiner S Certificate Form Mcsa 5876 Free To Edit The colorado uniform consumer credit code (uccc) is a state law that regulates the terms and conditions of consumer credit in the state of colorado. it sets maximum rates and charges, requires disclosure of the cost of credit so consumers may shop for the best rates, and provides remedies for consumers on default. Consumer credit code. editor's note: when originally enacted in 1971, articles 1 through 3 and 4 through 6 were based upon the uniform consumer credit code promulgated by the national conference of commissioners on uniform state laws; however it has been substantially amended in subsequent years and was the subject of a major rewrite in the 2000 session based upon recommendations of the office. The colorado uniform consumer credit code (“uccc”) authorizes the administrator to “adopt, amend, and repeal procedural rules to carry out the provisions of this code” with approval of the council of advisors on consumer credit subcommittee.1 the administrator is also empowered to “adopt rules not inconsistent with the federal. The uniform consumer credit code (uccc) is a model statute that provides standards for credit transactions entered into by individuals who purchase, use, maintain, and dispose of products and services. the uccc was originally approved by the national conference of commissioners on uniform state laws in 1968.

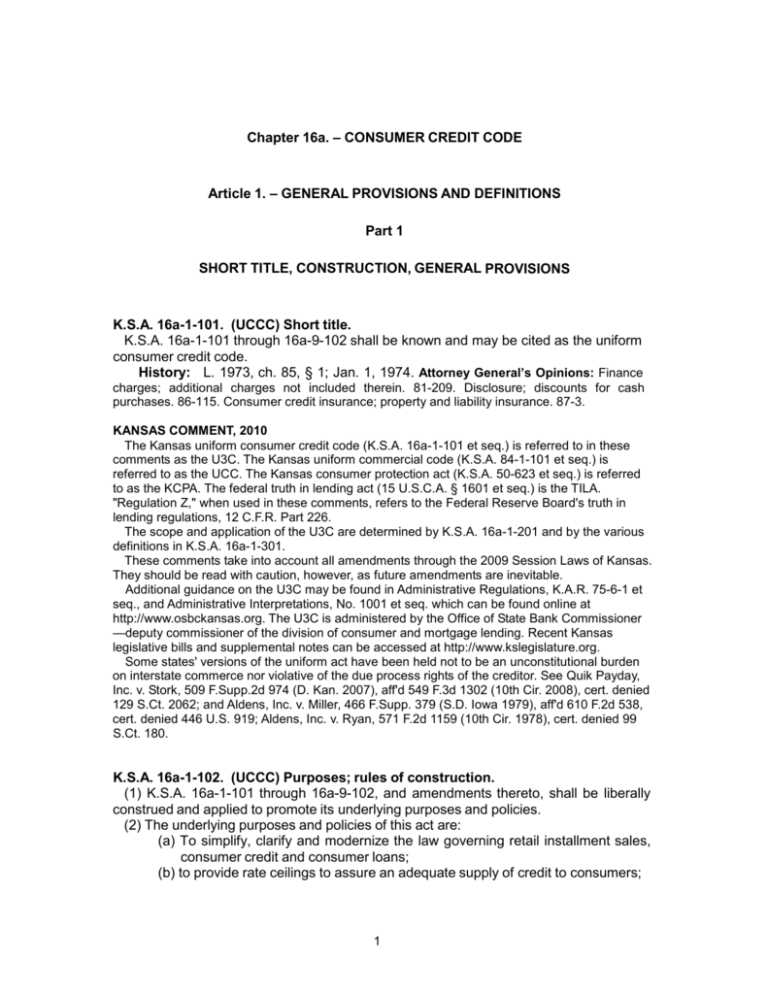

Fillable Online Cde Chart Of Accounts Fax Email Print Pdffiller The colorado uniform consumer credit code (“uccc”) authorizes the administrator to “adopt, amend, and repeal procedural rules to carry out the provisions of this code” with approval of the council of advisors on consumer credit subcommittee.1 the administrator is also empowered to “adopt rules not inconsistent with the federal. The uniform consumer credit code (uccc) is a model statute that provides standards for credit transactions entered into by individuals who purchase, use, maintain, and dispose of products and services. the uccc was originally approved by the national conference of commissioners on uniform state laws in 1968. Colorado revised statutes title 5. consumer credit code § 5 1 101. short title. current as of january 01, 2022 | updated by findlaw staff. articles 1 to 9 of this title shall be known and may be cited as the “uniform consumer credit code”, referred to in said articles as the “code”. back to chapter list. Notwithstanding the provisions of subsections (1), (2), and (3) of this section, the creditor, in connection with a consumer credit transaction other than a deferred deposit loan as defined in section 5 3.1 102 (3) or one pursuant to a revolving credit account, may contract for and receive a minimum loan finance charge of not more than twenty.

Uniform Consumer Credit Code Statutes Uccc Kansas Colorado revised statutes title 5. consumer credit code § 5 1 101. short title. current as of january 01, 2022 | updated by findlaw staff. articles 1 to 9 of this title shall be known and may be cited as the “uniform consumer credit code”, referred to in said articles as the “code”. back to chapter list. Notwithstanding the provisions of subsections (1), (2), and (3) of this section, the creditor, in connection with a consumer credit transaction other than a deferred deposit loan as defined in section 5 3.1 102 (3) or one pursuant to a revolving credit account, may contract for and receive a minimum loan finance charge of not more than twenty.

Colorado Uniform Consumer Credit Code Colorado Attorney General

Comments are closed.