Consumer Law I Fraud I Consumer Fraud I Regulatory Compliance I Unfair

Consumer Law I Fraud I Consumer Fraud I Regulatory Compliance I Unfair Bureaus & offices. the ftc’s bureau of consumer protection stops unfair, deceptive and fraudulent business practices by collecting reports from consumers and conducting investigations, suing companies and people that break the law, developing rules to maintain a fair marketplace, and educating consumers and businesses about their rights and. Consumer law i unfair practices i false advertising case study by: diana adjadj, esq. may 24, 2022 consumer law: “what is consumer law”? consumer law refer.

Consumer Law I Fraud I Consumer Fraud I Regulatory Compliance I Unfair Consumer law i fraud i consumer fraud i regulatory compliance i unfair practices act – unfair competition, what is it? by: diana adjadj, esq. june 14, 2022 unfair competition law unfair competition laws are geared to protect consumers from unjust business practices and to promote fair competition in the market. The ftc’s bureau of consumer protection stops unfair, deceptive and fraudulent business practices by: we collect complaints about hundreds of issues from data security and false advertising to identity theft and do not call violations. we use these complaints to bring cases, and we share them with law enforcement agencies worldwide for follow. Sometimes, the ftc “sweeps” an entire industry to ensure compliance with the law. 6.3 describe any complaints procedure for (i) consumers, and (ii) businesses. the ftc encourages consumers to file a complaint whenever they have been the victim of fraud, identity theft, or other unfair or deceptive business practices. Cfpb manual — unfair, deceptive, or abusive acts or practices provides an introduction to udaap and outlines regulatory requirements as well as related examination procedures. ftc policy statement on unfairness delineates the federal trade commission’s (ftc) views of the boundaries of its consumer unfairness jurisdiction.

Online Marketing I Consumer Fraud I Regulatory Compliance I Unfair Sometimes, the ftc “sweeps” an entire industry to ensure compliance with the law. 6.3 describe any complaints procedure for (i) consumers, and (ii) businesses. the ftc encourages consumers to file a complaint whenever they have been the victim of fraud, identity theft, or other unfair or deceptive business practices. Cfpb manual — unfair, deceptive, or abusive acts or practices provides an introduction to udaap and outlines regulatory requirements as well as related examination procedures. ftc policy statement on unfairness delineates the federal trade commission’s (ftc) views of the boundaries of its consumer unfairness jurisdiction. Overview. unfair, deceptive, or abusive acts and practices (udaap) can cause significant financial injury to consumers, erode consumer confidence, and undermine the financial marketplace. under the dodd frank wall street reform and consumer protection act (dodd frank act), it is unlawful for any provider of consumer financial products or. In 2010, congress passed the dodd frank act. section 1036 of the dodd frank act prohibits a “covered person”1 from engaging in unfair, deceptive, or abusive acts or practices (dodd frank udaap). see 12 u.s.c. § 5536. section 1031 of the dodd frank act provides authority to the consumer financial protection bureau (cfpb) to promulgate rules.

Consumer Fraud Law Word Cloud Template Stock Vector Royalty Free Overview. unfair, deceptive, or abusive acts and practices (udaap) can cause significant financial injury to consumers, erode consumer confidence, and undermine the financial marketplace. under the dodd frank wall street reform and consumer protection act (dodd frank act), it is unlawful for any provider of consumer financial products or. In 2010, congress passed the dodd frank act. section 1036 of the dodd frank act prohibits a “covered person”1 from engaging in unfair, deceptive, or abusive acts or practices (dodd frank udaap). see 12 u.s.c. § 5536. section 1031 of the dodd frank act provides authority to the consumer financial protection bureau (cfpb) to promulgate rules.

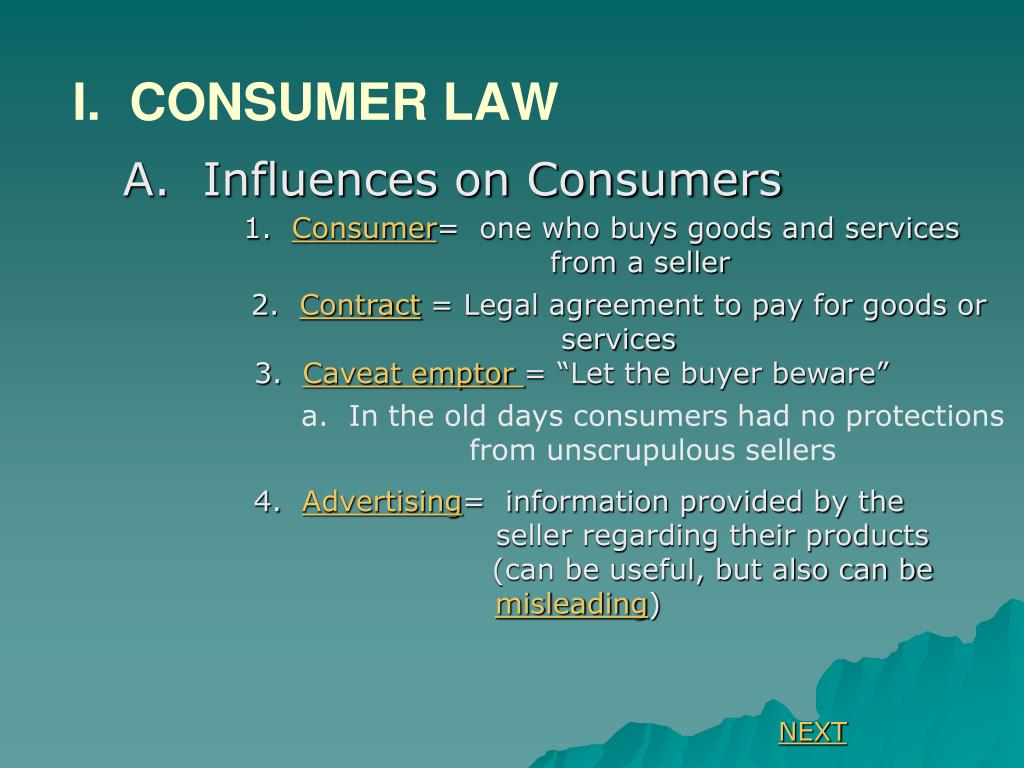

Ppt I Consumer Law Powerpoint Presentation Free Download Id 2062380

Comments are closed.