Difference Between Systematic And Unsystematic Risk With Table

Systematic Vs Unsystematic Risk The Key Differences Upwork Unsystematic risk, also named non systematic risk or diversifiable risk, is the fluctuations in returns of a company arising due to macro economic factors. these risk factors exist within the company and can be avoided if necessary action is taken. the risk factors can include producing undesirable products, labor strikes, etc. Systematic risk refers to the fluctuations in returns of an investment that are caused by factors that affect the entire market. unsystematic risk, on the other hand, is specific to a particular company or industry and can be diversified away. systematic risk is also known as market risk, whereas unsystematic risk is also called specific risk.

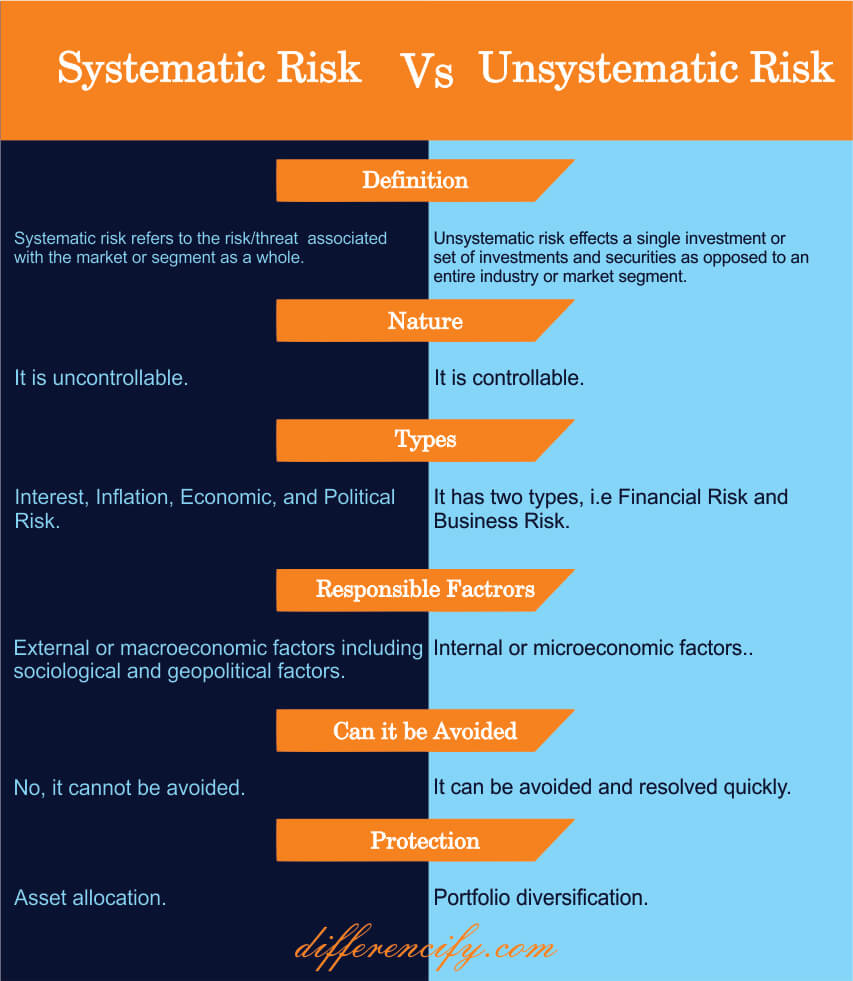

Difference Between Systematic And Unsystematic Risk With Table The basic differences between systematic and unsystematic risk is provided in the following points: systematic risk means the possibility of loss associated with the whole market or market segment. unsystematic risk means risk associated with a particular industry or security. systematic risk is uncontrollable whereas the unsystematic risk is. Whereas, unsystematic risk is associated with a specific industry, segment, or security. systematic risk is uncontrollable on a large scale, and multiple factors are involved. at the same time, unsystematic risk is controllable as it is restricted to a particular section. unsystematic risks are caused due to internal factors that can be. Systematic risk vs. unsystematic risk . the opposite of systematic risk is unsystematic risk, which affects a very specific group of securities or an individual security. unsystematic risk can be. The key differences between systematic risk vs unsystematic risk are as follows: systematic risks are uncontrollable in nature. unsystematic risks are controllable in nature. systematic risks are non diversifiable whereas unsystematic risks are diversifiable. systematic risks cannot be controlled, minimized, or eliminated by an organization or.

Comments are closed.