How To Do A Bank Reconciliation Easy Way

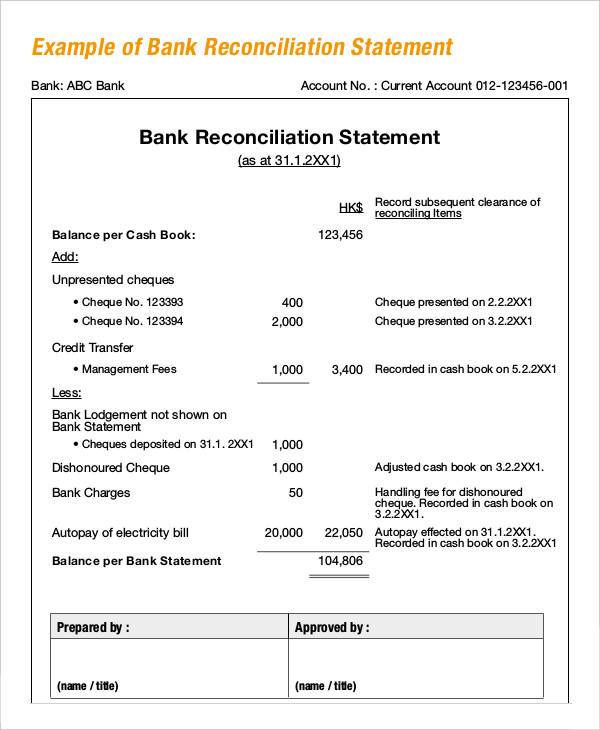

Bank Reconciliation Example 5 Free Word Pdf Documents Download Bank reconciliation use cases. when to do a bank reconciliation. how to do a bank reconciliation. 1. compare your bank statements. 2. add bank only transactions to your book balance. 3. add book transactions to your bank balance. 💥bank reconciliation cheat sheet → accountingstuff shopjoin me in this episode of accounting basics for beginners as i show you how to do a bank.

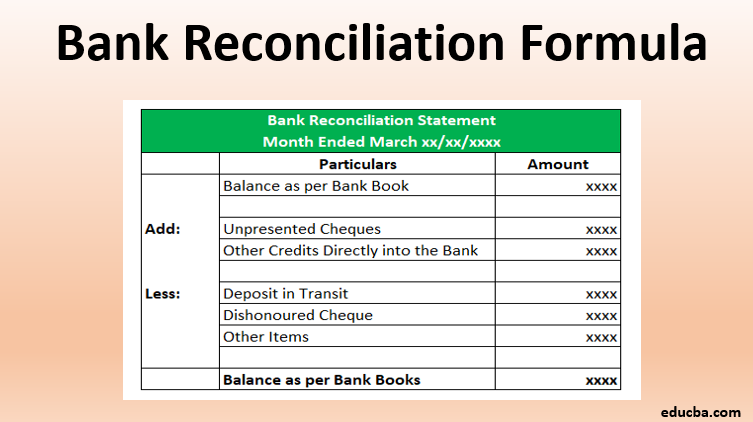

Free Bank Reconciliation Template Printable Templates Step 1 – find mismatches in bank statement and cash book. take the transaction history from the bank statement and copy it to another blank sheet. select cell h5 and insert the following formula. =match(c5,'cash book'!c13:c20,0) in this case, cells h5 and c5 are the first cell of the column match and transaction id. Here are 8 steps that will help you understand how to do bank reconciliation: 1. acquire bank statements. the first step is to obtain a detailed statement from the bank, which includes information about checks cleared and rejected by the bank, transaction charges, and bank fees. 2. Step 2. compare deposits. compare your personal transaction records to your most recent bank statement. first, make sure that all of the deposits listed on your bank statement are recorded in your. A bank reconciliation is the process by which a company compares its internal financial statements to its bank statements to catch any discrepancies and gain a clear picture of its real cash flow. we’ll explore the definition of bank reconciliation, why it’s important, and a step by step process for performing bank reconciliations.

Comments are closed.