Irs Identity Protection Pin What Is It How To Get It

All Taxpayers Can Now Get An Irs Identity Protection Pin Cpa Practice Using an ip pin to file. enter the six digit ip pin when prompted by your tax software product or provide it to your trusted tax professional preparing your tax return. the ip pin is used only on forms 1040, 1040 nr, 1040 pr, 1040 sr, and 1040 ss. correct ip pins must be entered on electronic and paper tax returns to avoid rejections and delays. An assistor will verify your identity and mail your ip pin to your address of record within 21 days. international users can call us at 1 267 941 1000 (not toll free) between 6 a.m. 11 p.m. eastern time. exception: it’s after october 14 and you haven’t filed your current or prior year forms 1040 or 1040 pr ss.

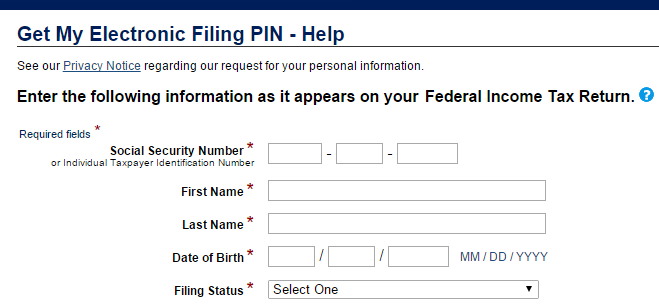

How To Get An Irs Identity Protection Pin Ip Pin Enter your ip pin(s) as applicable in the boxes marked "identity protection pin" in signature area of the form 1040 tax return. each taxpayer who has an ip pin must enter it on their tax return if married and filing a joint return, see question 6 above. 2. use the online tool to get an ip pin. after you create an online account, use the “get an ip pin” button on the irs website to register for a pin. you can access the ip pin tool from mid. An identity protection pin (ip pin) is a unique six digit number known only to the taxpayer and the irs; it helps prevent the misuse of the taxpayer’s social security number (ssn) or individual taxpayer identification number (itin) on fraudulent federal income tax returns. in calendar year 2022, about 525,000 taxpayers opted in to the irs’s. An ip pin is a six digit number that prevents someone else from filing a tax return using your ssn or itin. the ip pin is known only to you and the irs and helps verify your identity when you file your electronic or paper tax return. the ip pin is valid for one year. each january, a newly generated ip pin must be obtained.

Irs Identity Protection Pin What Is It How To Get It An identity protection pin (ip pin) is a unique six digit number known only to the taxpayer and the irs; it helps prevent the misuse of the taxpayer’s social security number (ssn) or individual taxpayer identification number (itin) on fraudulent federal income tax returns. in calendar year 2022, about 525,000 taxpayers opted in to the irs’s. An ip pin is a six digit number that prevents someone else from filing a tax return using your ssn or itin. the ip pin is known only to you and the irs and helps verify your identity when you file your electronic or paper tax return. the ip pin is valid for one year. each january, a newly generated ip pin must be obtained. Identity protection pin (ip pin). an ip pin is a six digit number the irs assigns to a taxpayer that works as “two factor authentication.”. once an ip pin is assigned to a taxpayer, only a person who has the taxpayer’s ip pin (and all the taxpayer’s other identification information) can file a tax return for that taxpayer. The irs says that the quickest way to get an ip pin is to use the online get an ip pin tool. you must have an irs online account to validate your identity and the ip pin tool is generally.

Comments are closed.