Nmls Exam Real Estate Settlement Procedures Act Respa Disclosures Overview

Nmls Exam Real Estate Settlement Procedures Act Respaођ Hud was the previous enforcer. false (respa does not apply to loans secured by commercial properties) true or false: respa applies to loans secured by commercial properties. vacant land. respa does not apply to (unless a dwelling is intended to be constructed on the land within two years): 25 or more acres. The hud 1 or the hud 1a settlement statement is. due at the time of closing, but the borrower may request a copy one business day prior to settlement. study with quizlet and memorize flashcards containing terms like real estate settlement procedures act (respa) will be administered and enforced by what agency:, real estate settlement procedures.

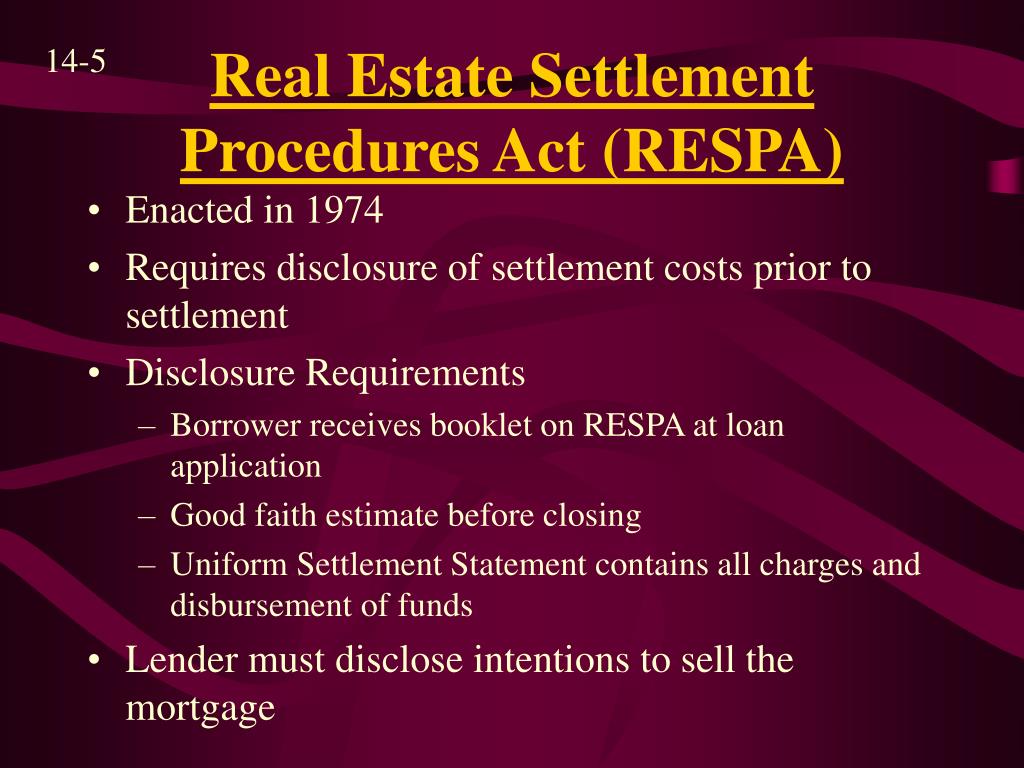

Ppt Chapter 14 Powerpoint Presentation Free Download Id 3540324 This is our module on the real estate settlement procedures act respa disclosures overview for the nmls safe exam. The real estate settlement procedures act (respa) is a federal statute that protects borrowers involved in using residential mortgage loans for the purchases of which of the following a) 1 to 4 family dwellings (b) condominiums (c) commercial real estate property (d) only a and b. Resources to help industry participants understand, implement, and comply with the real estate settlement procedures act (respa) and regulation x. featured topic on september 1, 2023, the cfpb released a non exhaustive list of hud issued official rules, interpretations, or policy statements that continue to be applied today by the cfpb. The real estate settlement procedures act (respa) provides consumers with improved disclosures of settlement costs and to reduce the costs of closing by the elimination of referral fees and kickbacks. respa was signed into law in december 1974, and became effective on june 20, 1975. the law has gone through a number of changes and amendments.

Comments are closed.