State Street Strategic Asset Allocation Etf Portfolios

State Street Strategic Asset Allocation Etf Portfolios State street strategic asset allocation etf portfolios. key facts. objective. seeks to provide optimal capital efficiency over a long term horizon. the more conservative model portfolios are designed to generate current income, with some consideration given to growth of capital. the more aggressive portfolios are predominantly focused on growth. State street active asset allocation etf portfolios. key facts. seeks to outperform the benchmark over a full market cycle. focuses on identifying opportunities in the global capital markets. 15 year track record (inception date: 11 01 08) objective. seeks to capitalize on short and long term mispricing in the global equity and fixed income.

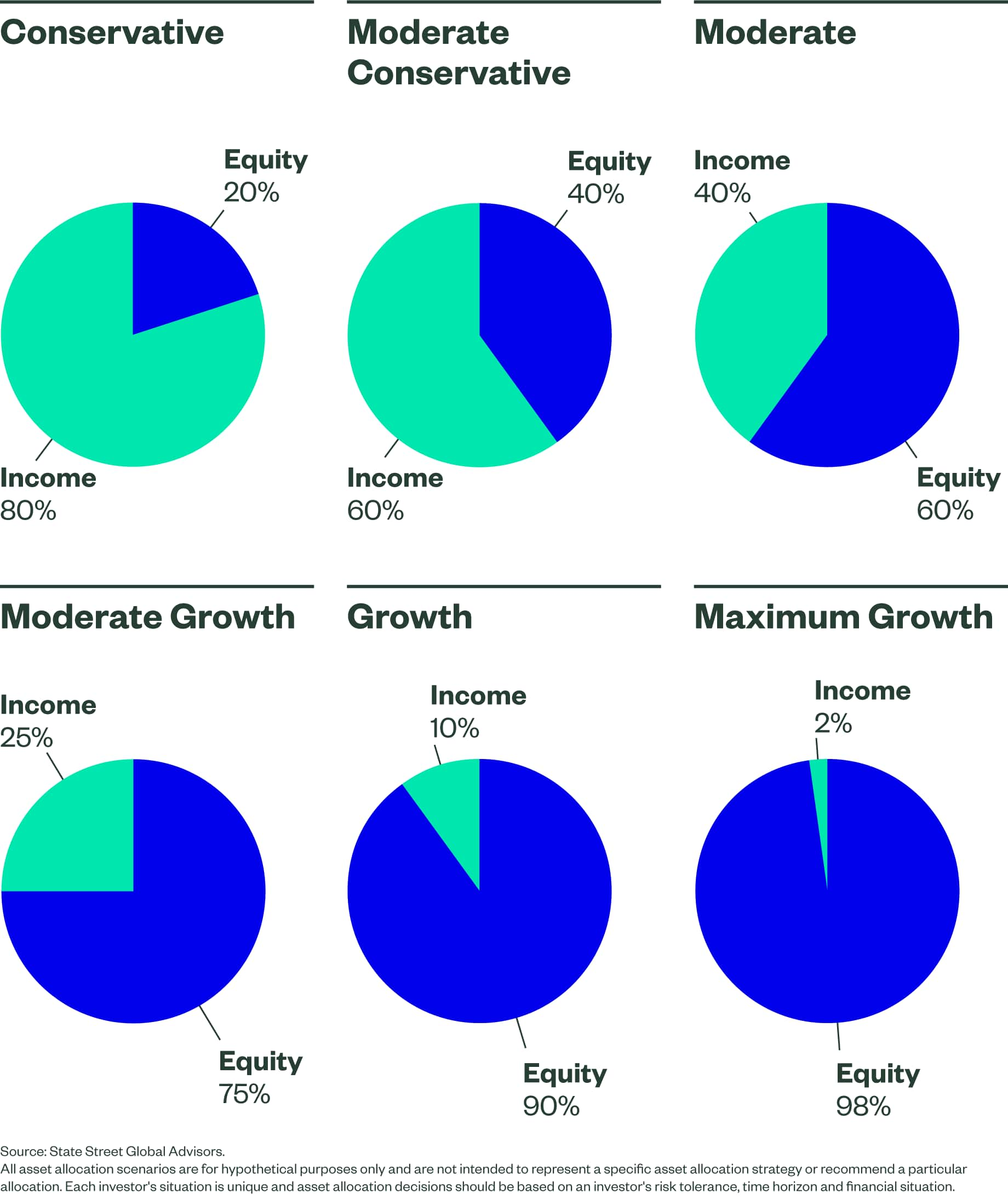

What Is Strategic Asset Allocation The state street strategic asset allocation etf portfolios seek a distinct balance of risk and return. the more aggressive portfolios focus on long term growth, while the more conservative portfolios emphasize current income and capital preservation. all of the strategic asset allocation etf portfolios seek broad diversification. Review our list of all state street etfs that are available to invest in. sort by star asset allocation 1 to 25 of 159 results. spdr® portfolio s&p 500® etf: splg: large blend: 21.63%: 24:. For bachher, etfs offer a more nimble and cost efficient way to execute on the university’s asset allocation strategies, whether the goal is seeking increased returns or managing risk. celebrating 30 years of etf innovation. 2023 marks the 30th anniversary of the launch of the industry’s first us listed exchange traded fund. State street’s strategic asset allocation series features a robust quantitative framework that’s been seamlessly integrated into thoughtful portfolio construction. the strategic asset.

State Street Etf Model Portfolios For bachher, etfs offer a more nimble and cost efficient way to execute on the university’s asset allocation strategies, whether the goal is seeking increased returns or managing risk. celebrating 30 years of etf innovation. 2023 marks the 30th anniversary of the launch of the industry’s first us listed exchange traded fund. State street’s strategic asset allocation series features a robust quantitative framework that’s been seamlessly integrated into thoughtful portfolio construction. the strategic asset. Please review its terms, privacy and security policies to see how they apply to you. j.p. morgan asset management isn’t responsible for (and doesn't provide) any products, services or content at this third party site or app, except for products and services that explicitly carry the j.p. morgan asset management name. State street global advisors. for four decades, state street global advisors has served the world’s governments, institutions and financial advisors. with a rigorous, risk aware approach built on research, analysis and market tested experience, we build from a breadth of active and index strategies to create cost effective solutions.

Comments are closed.