How to Evaluate Rental Properties for Maximum ROI

Maximizing Your Rental ROI: A Step-by-Step Guide to Evaluating Properties

Investing in rental properties can be a lucrative venture, but maximizing your return on investment (ROI) requires careful evaluation and strategic planning. This article will guide you through the essential steps to evaluate rental properties and ensure you make the most profitable choices.

1. Define Your Investment Goals & Criteria:

- Determine your investment horizon: Short-term (flipping) or long-term (passive income)?

- Set your budget: Consider your available capital and potential financing options.

- Establish your desired ROI: Aim for a realistic target based on market trends.

- Identify your ideal property type: Single-family home, multi-family unit, or commercial property?

- Choose your preferred location: Consider factors like rental demand, property values, and potential for appreciation.

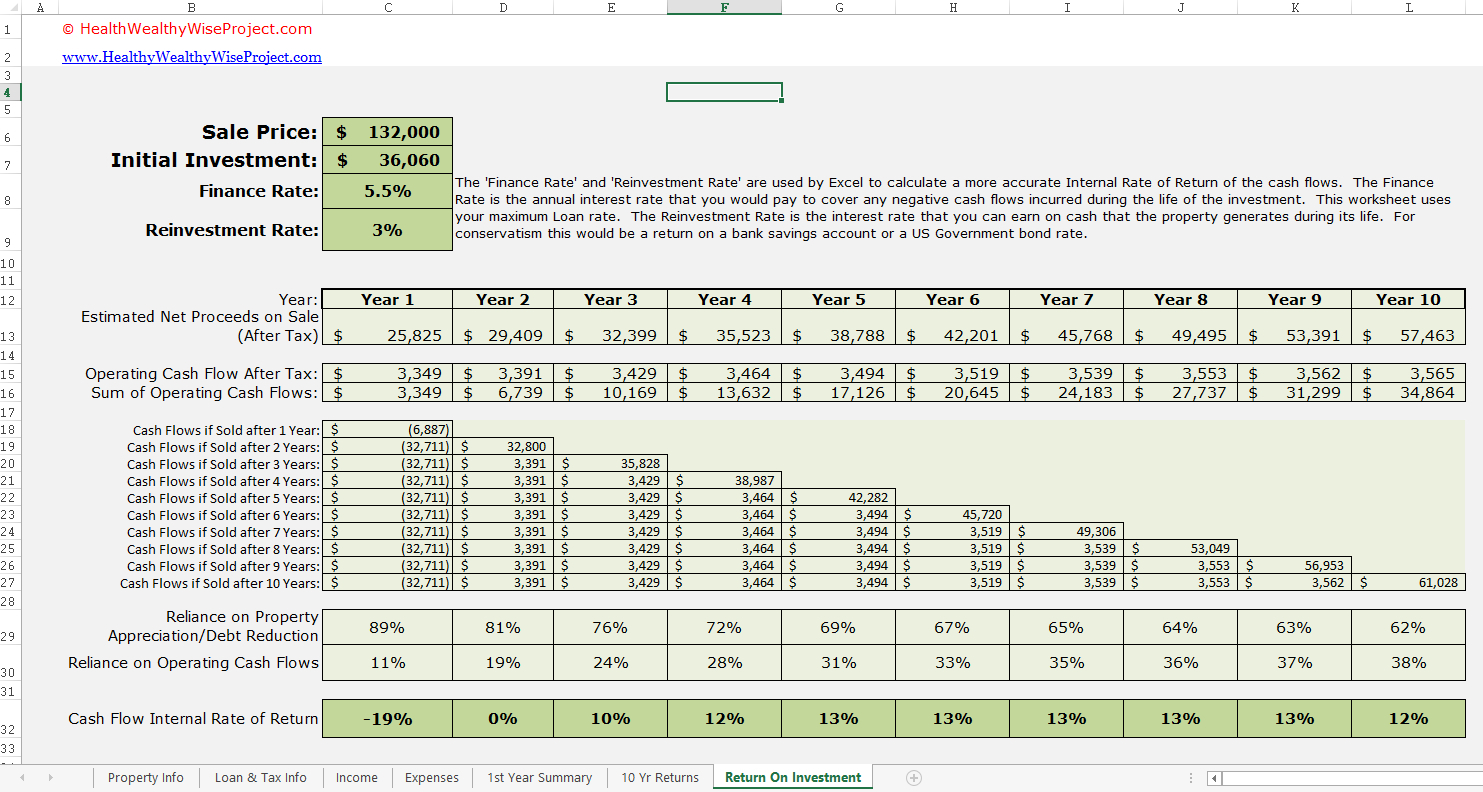

2. Analyze the Property’s Financial Viability:

- Calculate the rental income potential: Research average rents for comparable properties in the area.

- Estimate operating expenses: Include property taxes, insurance, maintenance, utilities, and property management fees.

- Determine the net operating income (NOI): Subtract operating expenses from gross rental income.

- Calculate the capitalization rate (cap rate): Divide the NOI by the purchase price to assess profitability.

- Assess the potential for appreciation: Consider the property’s location and the projected growth of the real estate market.

3. Conduct a Thorough Due Diligence:

- Inspect the property: Look for any signs of damage, neglect, or potential for future repairs.

- Review the property history: Check for past issues, liens, or code violations.

- Investigate the neighborhood: Consider crime rates, schools, and proximity to amenities.

- Research the local rental market: Understand the vacancy rates, tenant demographics, and average rent increases.

- Consult with professionals: Engage a real estate agent, property inspector, and attorney for expert advice.

4. Evaluate the Property’s Potential for Enhancement:

- Consider renovation and modernization: Updating kitchens, bathrooms, and landscaping can increase rental rates.

- Explore energy efficiency upgrades: Reduce utility costs and attract eco-conscious tenants.

- Assess potential for expansion or conversion: Explore adding a unit or converting existing space.

- Evaluate the impact of market trends: Adapt to changing preferences and evolving rental demands.

5. Secure Financing and Manage Your Investment:

- Compare mortgage rates and terms: Choose the financing option that aligns with your goals.

- Secure a rental management service: Professional management can alleviate the burden of tenant screening, rent collection, and maintenance.

- Implement a strong tenant screening process: Protect your investment by selecting reliable and responsible renters.

- Maintain regular communication with tenants: Foster positive relationships and address concerns promptly.

Conclusion:

Evaluating rental properties for maximum ROI requires a comprehensive approach. By meticulously analyzing the property’s financials, conducting thorough due diligence, considering potential for enhancement, and implementing effective management practices, you can ensure your rental investment delivers consistent returns and maximizes your financial success.