How to Finance Your Real Estate Investments: A Guide to Loans and Mortgages

How to Finance Your Real Estate Investments: A Guide to Loans and Mortgages

Investing in real estate can be a lucrative endeavor, but it often requires a significant upfront investment. Fortunately, various financing options can help you secure the funds you need. This guide will explore the most common real estate loans and mortgages, providing insights into the pros and cons of each to help you make informed decisions.

Understanding Loan Types:

- Conventional Loans: These are traditional mortgages offered by banks and credit unions. They typically require a down payment of 20% or more and have stricter credit score requirements. However, they offer lower interest rates and fixed monthly payments.

- FHA Loans: Backed by the Federal Housing Administration, these loans offer more lenient credit requirements and allow for lower down payments (as low as 3.5%). However, they come with mortgage insurance premiums and may have slightly higher interest rates.

- VA Loans: Available to eligible veterans and active-duty military personnel, these loans offer no down payment requirement and competitive interest rates. They also have no private mortgage insurance (PMI).

- USDA Loans: Targeted towards rural areas, these loans offer low interest rates and flexible terms, often with no down payment required.

Mortgages for Real Estate Investments:

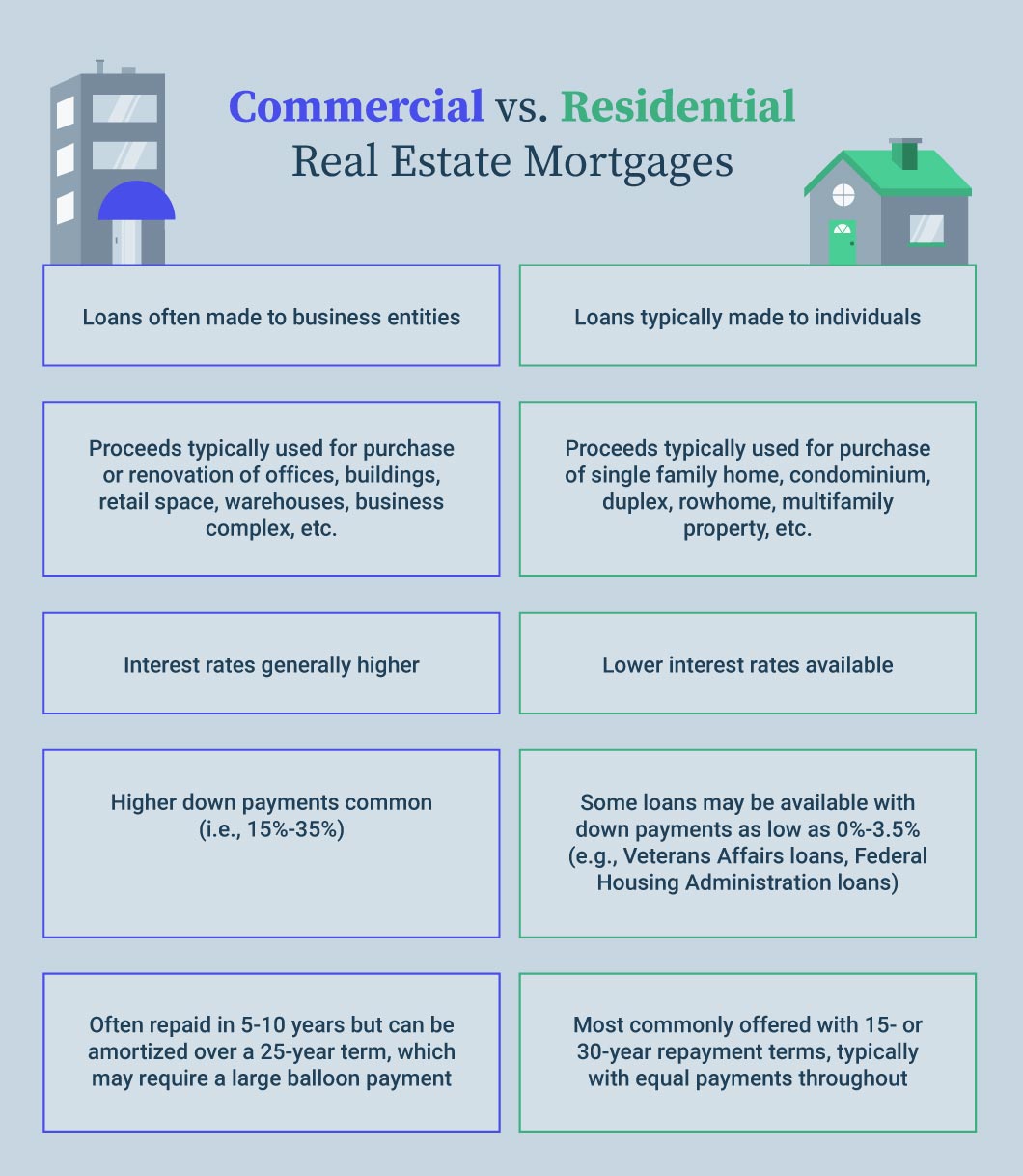

- Investment Property Loans: These loans are specifically designed for properties you intend to rent out. They typically have higher interest rates and stricter underwriting guidelines compared to conventional home loans.

- Commercial Loans: Ideal for larger commercial properties like office buildings, retail stores, or industrial spaces, these loans require extensive documentation and have unique terms based on the specific property and borrower.

- Hard Money Loans: Private lenders offer these loans for short-term financing, often with higher interest rates and fees. They are typically used for quick renovations or to bridge financing gaps.

- Bridge Loans: Similar to hard money loans, these loans help you secure financing until you can obtain a more traditional mortgage. They typically have a shorter term and higher interest rates.

Essential Tips for Choosing the Right Loan:

- Assess Your Financial Situation: Carefully evaluate your credit score, income, and savings before applying for a loan.

- Research Different Loan Options: Compare interest rates, terms, and fees offered by various lenders to find the best fit for your needs.

- Understand the Loan Requirements: Ensure you meet the credit score, down payment, and other eligibility criteria for the loan you choose.

- Factor in Closing Costs: Don’t forget about closing costs, which can significantly add to your overall loan expenses.

- Get Professional Advice: Consult with a financial advisor or mortgage broker to gain valuable insights and tailored advice.

Conclusion:

Securing financing is crucial for any successful real estate investment. By understanding the various loan types and mortgages available, you can navigate the process confidently and choose the right option to meet your specific needs and goals. Remember to research thoroughly, compare options, and seek professional guidance to make informed decisions.