Understanding Real Estate Market Cycles and How They Affect You

Riding the Wave: Understanding Real Estate Market Cycles and How They Affect You

The real estate market, like the ocean, is constantly in motion. It ebbs and flows in cycles, experiencing periods of boom and bust, growth and stagnation. Understanding these cycles can be crucial for anyone involved in the real estate world, whether you’re a buyer, seller, investor, or simply curious about the market’s pulse.

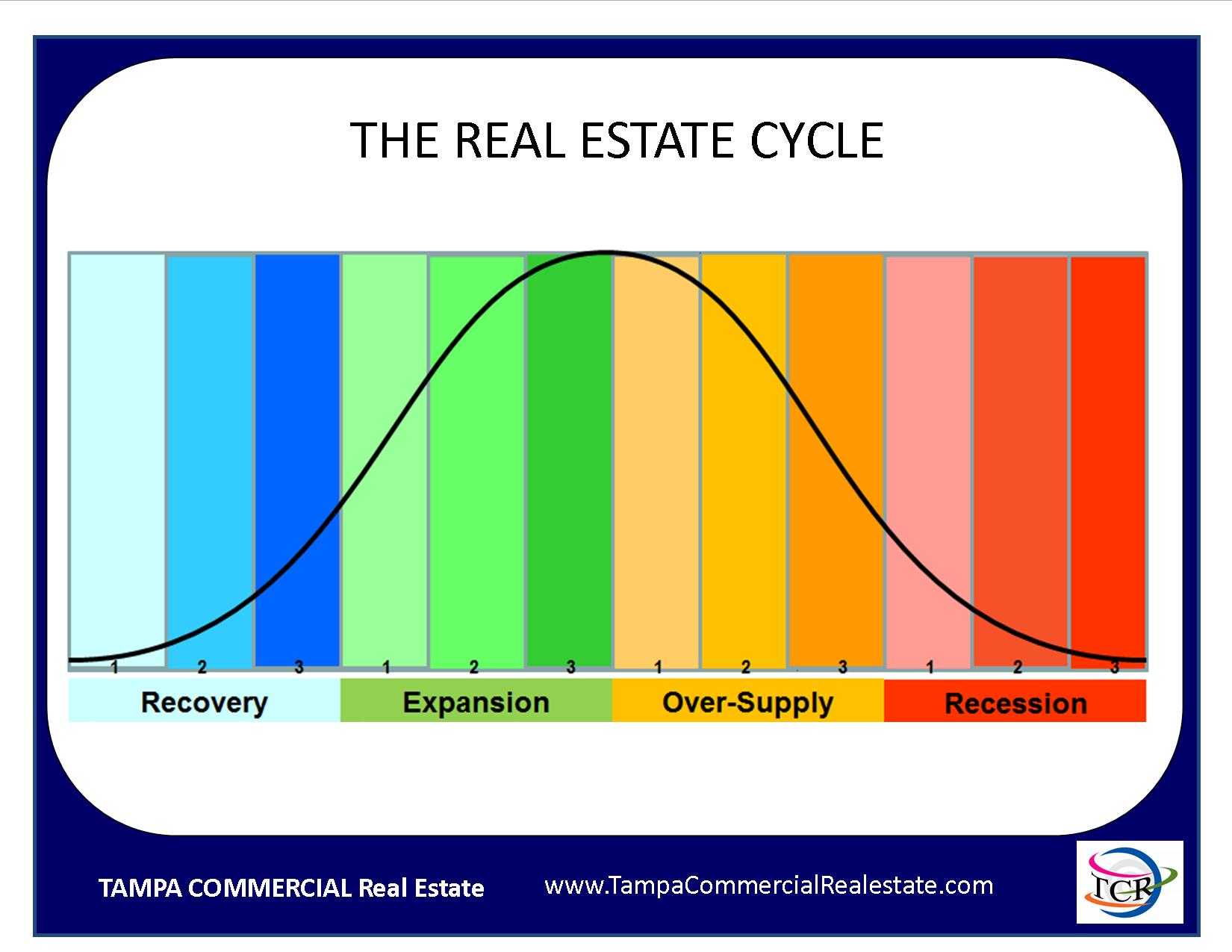

The Upswing:

- Characterized by: Rising prices, increased demand, low inventory, and a competitive market.

- Implications for buyers: Higher prices, limited options, potential need for bidding wars, and difficulty securing financing.

- Implications for sellers: Favorable market conditions, potentially quick sales, and high selling prices.

- Implications for investors: Potential for high returns, but also increased risk of overvaluation.

The Peak:

- Characterized by: Prices plateauing or even starting to decline, slowing demand, and a more balanced market.

- Implications for buyers: Prices may be slightly lower, less competition, and a wider selection.

- Implications for sellers: Slower sales, potential need for price adjustments, and a shift in bargaining power.

- Implications for investors: Returns may start to slow, and it may be time to consider adjusting investment strategies.

The Downswing:

- Characterized by: Declining prices, lower demand, increased inventory, and a buyer’s market.

- Implications for buyers: Lower prices, more negotiating power, and a wider selection.

- Implications for sellers: Lower selling prices, longer selling times, and a more competitive market.

- Implications for investors: Potential for losses, but also opportunities to acquire properties at lower prices.

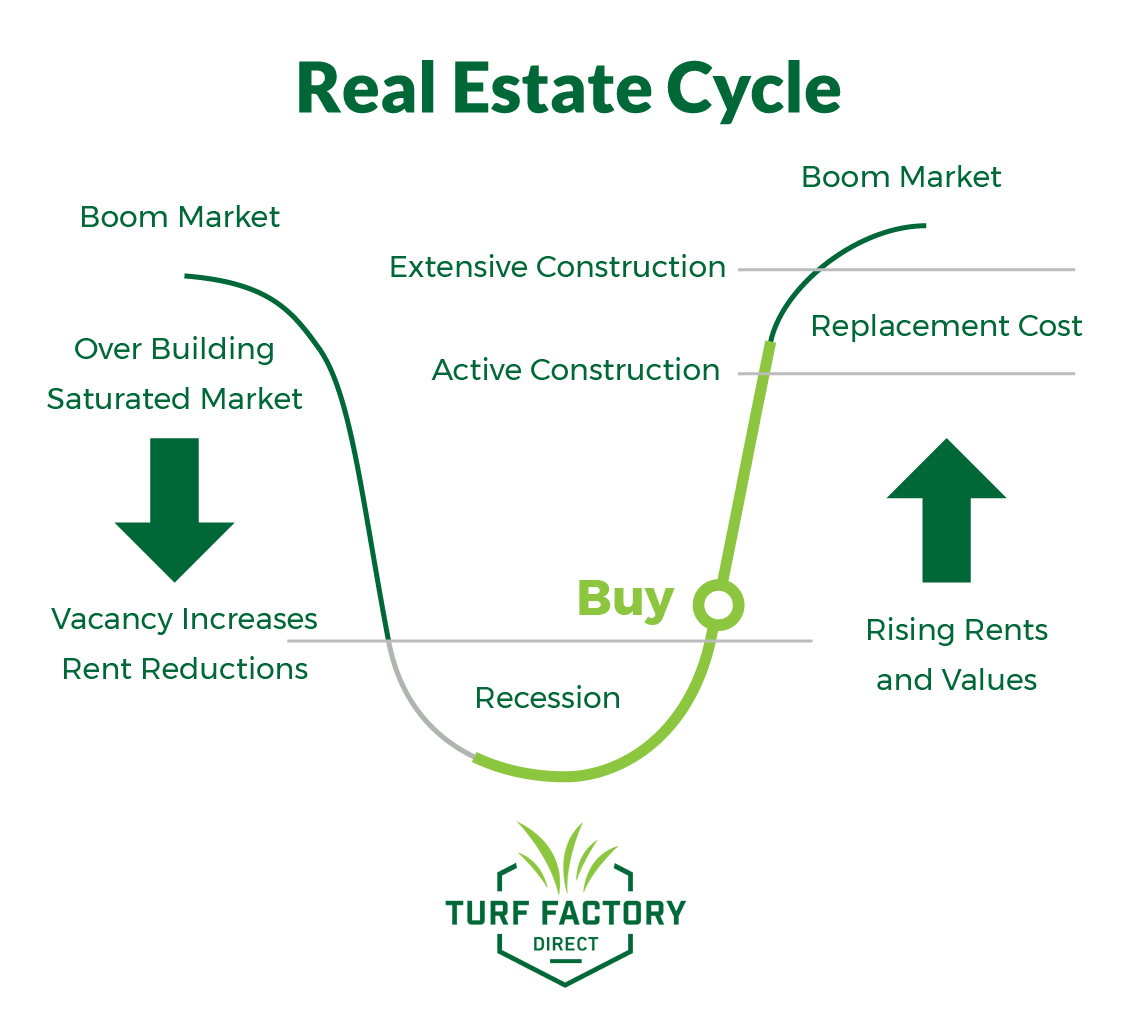

The Trough:

- Characterized by: Lowest prices, limited demand, high inventory, and a buyer’s market.

- Implications for buyers: Best time to buy, lowest prices, and a large selection of properties.

- Implications for sellers: Difficult market conditions, potential for low selling prices, and extended selling times.

- Implications for investors: Potential for undervalued properties and future gains, but also significant risks.

Understanding the Cycle’s Drivers:

Several factors drive the real estate market cycles, including:

- Economic conditions: Interest rates, employment levels, inflation, and consumer confidence.

- Government policies: Tax laws, zoning regulations, and housing policies.

- Demographics: Population growth, age distribution, and migration patterns.

- Supply and demand: Available inventory, building permits, and construction costs.

How to Navigate the Cycles:

- Buyers: Research thoroughly, be patient, and be prepared to act quickly when the market favors buyers.

- Sellers: Consult with real estate professionals, price your property competitively, and be prepared to adjust your expectations.

- Investors: Diversify your portfolio, focus on long-term trends, and be aware of the risks associated with different market stages.

The Bottom Line:

Understanding real estate market cycles can help you make informed decisions and navigate the ever-changing landscape of the housing market. By staying informed and preparing for the different phases of the cycle, you can increase your chances of success in this dynamic and unpredictable market.